Transforming the Regulatory Landscape for Financial Entities

The Securities and Exchange Board of India (SEBI) is making a significant shift towards cloud computing within the financial sector. By developing a dedicated framework, SEBI ensures that regulated entities (REs) can leverage cloud services effectively while adhering to stringent security and compliance standards.

Cloud computing is reshaping business landscapes by offering scalability, efficiency, and cost-reduction benefits. Recognizing its potential, financial entities under SEBI’s purview are adopting the cloud to augment their services. However, this transition is not without challenges, notably data security risks, cyber threats, and compliance hurdles. SEBI’s framework is crafted to mitigate these risks, ensuring a secure and compliant cloud adoption pathway for REs.

Ground Rules for Cloud Adoption

- Identifying and Mitigating Risks

At the framework’s core is a comprehensive risk assessment, obligating REs to scrutinize potential cloud adoption risks. This involves evaluating a cloud service provider’s (CSP) security measures, data privacy practices, and alignment with regulatory demands.

- CSP Selection: SEBI’s Checklist

Selecting a CSP is crucial, emphasizing the need for a track record in security and compliance, alongside a willingness to meet SEBI’s specific regulatory requirements.

- Prioritizing Data Security and Sovereignty

SEBI mandates a meticulous data classification strategy, with particular emphasis on storing sensitive data within India. Furthermore, it requires robust data encryption and secure key management practices.

- Ensuring Strict Access Control

The framework advises stringent access management protocols, such as multi-factor authentication, to limit cloud resource access to authorized personnel only.

- Continuous Monitoring and Compliance Audits

Regular monitoring and auditing processes are vital for ensuring ongoing compliance with the framework’s stipulations.

Elevating Cloud Security Standards

To fortify cloud resources against potential threats, REs must implement comprehensive security measures, including data encryption, firewall configurations, and proactive vulnerability management.

- Adhering to SEBI’s Compliance Directives

Beyond security, the framework stipulates strict compliance requirements such as data localization, privacy adherence, and regular regulatory reporting to SEBI.

- The Tangible Benefits of SEBI’s Cloud Framework

Adopting cloud services under this framework not only strengthens security and compliance but also enhances operational efficiency and improves customer service.

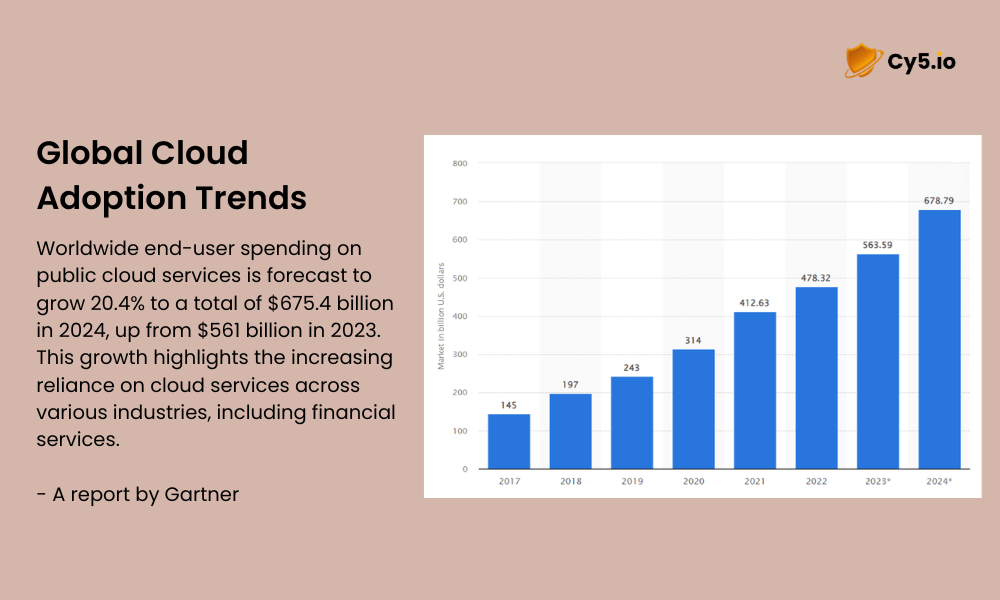

- Global Cloud Adoption: A Financial Perspective

Reflecting on a broader scale, Gartner’s forecasts indicate a surge in public cloud spending, signalling the growing reliance on cloud services across all sectors, including finance.

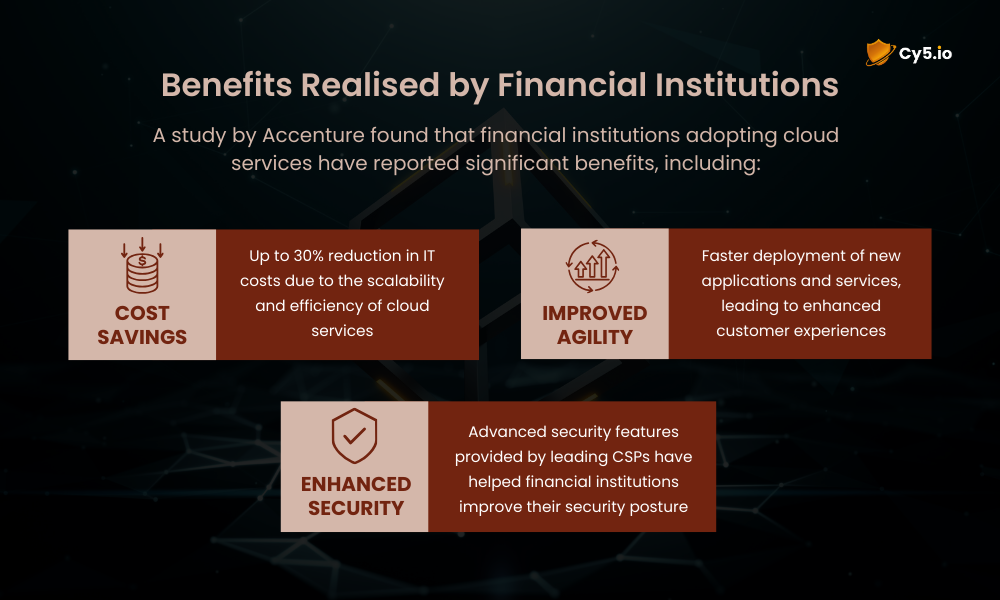

- Performance and Cost-Effectiveness

Accenture’s study underscores the tangible benefits for financial institutions moving to the cloud, from significant IT cost savings to improved security postures and enhanced agility.

Cloud Security and Compliance with Cy5

Cy5 stands ready to assist SEBI-regulated entities in navigating cloud adoption challenges. With specialized security and compliance solutions, Cy5 ensures that cloud deployments meet stringent requirements.

Cy5’s cloud security platform, assessment tool, monitoring service, and incident response platform can help REs evaluate and mitigate cloud security risks, and monitor cloud resources.

The Future of Finance with SEBI’s Cloud Adoption Guidelines

In conclusion, SEBI’s cloud adoption framework is a landmark initiative, guiding REs to harness the cloud’s potential securely and compliantly. As the finance sector evolves, cloud technology is undoubtedly becoming a cornerstone of its future.

This version of the blog is designed to captivate the reader by providing a clear, structured overview of SEBI’s efforts to regulate and facilitate cloud adoption in the Indian financial sector.

(ref) Find complete SEBI’s Framework: https://www.sebi.gov.in/legal/circulars/mar-2023/framework-for-adoption-of-cloud-services-by-sebi-regulated-entities-res-_68740.html